Now that the European Central Bank is designing the digital euro and the European Commission has published a proposal for a legal framework, the introduction of the digital euro is approaching. Still, it is wise to experiment a bit more first.

In brief

- With the digital euro, the European Central Bank opts for complementarity and cooperation with the private sector.

- The added value of a digital euro is as yet unknown to users.

- There seem to be insufficient incentives to distribute the digital euro.

In het kort

This is an translation of the dutch article.

In 2019, the Dutch Economic Statistical Journal (ESB) paid attention to digital central bank money in the special edition on Public Money. Besides oppotunities and possibilities (Metzemakers, 2019; Lelieveldt, 2019), the benefits of its introduction were questioned (Boonstra, 2019; Houben and Reijnders, 2019).

Afterwards, the debate on digital central bank money gained momentum worldwide. The European Central Bank (ECB) launched an investigation phase into a digital euro in late 2021 and has published four reports on its progress in now. These have been commented on by a number of independent experts at the request of the European Parliament. In this article, I conclude on the basis of these reports, their comments and the European Commission’s (EC’s) legislative proposal that the current proposal for the design of the digital euro is still unfinished.

Preserving public money in digitisation

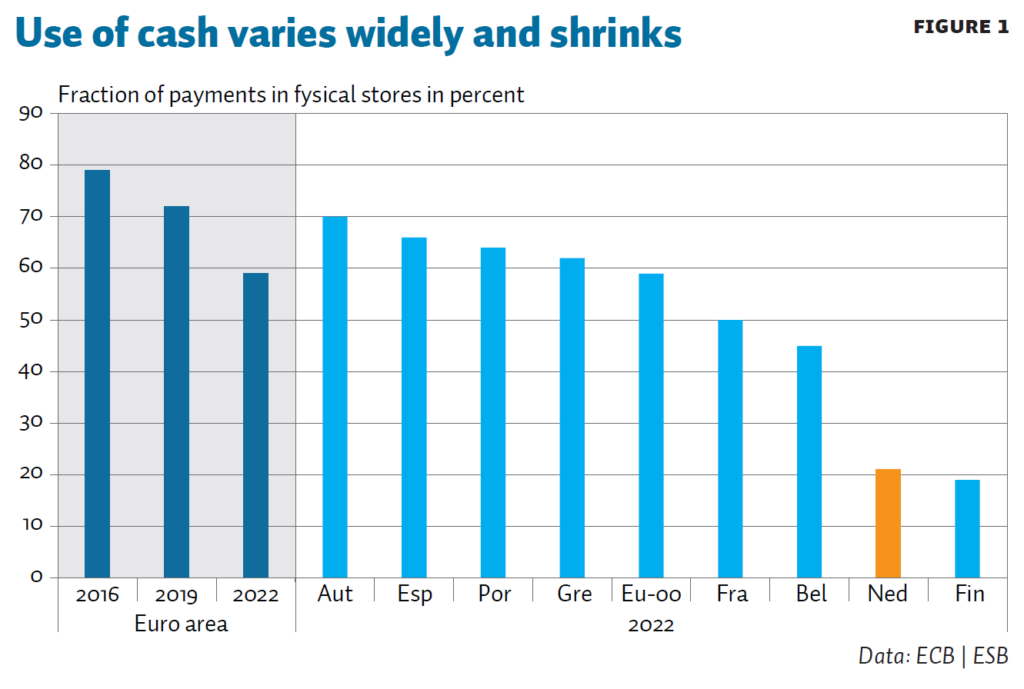

Digitisation in payments has led to a sharp reduction in the use of cash (public money) over the past decade. Despite this, the vast majority of payments in physical shops in the euro area are still made in cash (59 per cent; Figure 1). In Austria it is even 70 per cent, in the Netherlands and Finland – leaders in digitalisation – around 20 per cent.

As the use of cash declines, central banks are concerned about whether public money will remain readily available in the future. In addition, Facebook’s 2019 announcement to set up a global payment system, as well as the rise of crypto-assets, contributed to an elaboration of ideas around digitalisation of current cash. Central banks realized that, in the digital age, they had been on hold for too long with a development of the paper banknote (Bindseil, 2021). Meanwhile, digital central bank money is on the agenda in 94 countries- ranging from exploration, and from pilots to introduction (Bahamas, Jamaica, Nigeria). China has been conducting pilots with the digital yuan in more and more regions since 2020. In all countries, the starting point is that digital central bank money does not replace cash, but as a digital alternative, alongside cash. Digital central bank money can be distinguished into wholesale central bank money and retail central bank money. The former deals with (digital) reserves that banks hold with the central bank for, inter alia, settlement of payments and monetary policy purposes; the latter deals with the digitisation of cash. A survey by the Bank of International Settlements found that seventy per cent of central banks, are (also) researching wholesale digital central bank money (Kosse and Mattei, 2023). At the heart of this is, among other things, making cross-border payments between currency blocs more efficient. In the context of this article, which focuses on the digitisation of public money, this will not be discussed further.

Central banks pursue different goals with (retail) digital central bank money, with the ranking differing by geographical area. For emerging markets and developing countries, financial inclusion and improving the efficiency of the payment system is an important reason (Kosse and Mattei, 2023). In almost all countries, financial stability is high on the ‘argument ladder’. Being able to continue to conduct its own, autonomous, monetary policy is also often mentioned as a reason (Prasad, 2021). Highly digitalised countries see digital central bank money as a relevant fall-back function in case of disruptions to the current payment infrastructure (Sleijpen, 2023).

Monetary anchor as a beacon of confidence

The ECB sees three objectives for a digital euro (ECB, 2022a). First, preserving public money as a monetary anchor for the financial system. With this, the ECB aims to ensure that the convertibility of commercial bank money for public money should never be threatened by a reduction in the use of cash. History has shown that this guaranteed convertibility between private and public money is essential for confidence in money, in the payment system and for financial stability (Panetta, 2022a). A digital euro, widely available to the public, ensures that the monetary anchor is maintained in a digital world. . However, this argument is not uncontroversial. Bofinger and Haas (2023) see an insufficient role for the digital euro to act as a monetary anchor if it is limited exclusively to a means of payment for consumers (entrepreneurs cannot pay with it). In their analysis, the role of anchor is fulfilled by monetary policy, which aims at price stability. Angeloni (2023) and Niepelt (2023) take a similar view in their reports to the European Parliament. Houben and Reijnders (2019) concluded this earlier. Grünewald (2023), on the contrary, considers the role of monetary anchor central from a confidence point of view. Brunnermeier and Landau (2022) also point to this aspect, to which they attach the condition that a digital euro must then be widely available. They see public money as essential for maintaining financial stability, which Sleijpen (2023) also points out.

Second, there is protecting the strategic autonomy of European payment systems. A large proportion of electronic point-of-sale and online payments are currently based on products from non-European providers. While these have led to many innovative applications, efficiency and ease of use, in a further digitalizing Europe, the ECB wants to avoid complete dependence on these (often data-driven) parties. Payments has become an increasingly strategic element in geopolitical relations, and this is where an autonomous European solution fits in – reducing this dependency.

And third, there is the fostering of efficiency and innovation. Despite more than 20 years of the euro’s existence, there is still no full single market for payments. The ECB aims to put an end to this fragmentation of payment methods with a digital euro, alongside a number of private – and ECB- and EC-supported – initiatives, which pursue the same goal.

Risks and preconditions

A digital euro could lead to disintermediation (the removal of the role of banks) and a greater likelihood of a bank run in a crisis situation (Metzemakers, 2019; DNB, 2020; ECB, 2022b). To mitigate these risks, the ECB undertakes to introduce control measures. At the heart of these measures is that a digital euro cannot be used as a hoarding tool. This role of money remains part of the commercial banking operations. An upper limit on the balance to be held or a system of renumeration, with a lower interest rate the higher the balance, will have to prevent this (ECB, 2022b). ECB executive board member Panetta has indicated that he is thinking of a maximum balance of 3,000 to 4,000 euros per capita (Panetta, 2022b). The EC bill gives the ECB the power to set such a cap.

However, these control measures are not uncontroversial. Monnet (2023) and Niepelt (2023) believe that the introduction of a cap does not make a digital euro attractive. While they acknowledge the risks of disintermediation and a bank run, they expect that – after an adjustment period – disciplining behaviour in the banking sector mitigates these risks. A similar view was put forward earlier (WRR, 2019). Hoffmann (2023) is also not in favour of caps, and thinks they should, after an introduction period, disappear quickly. This would also make monetary transmission more effective. Grünewald (2023) argues that a system of caps leads to cash remaining the only monetary anchor for the public, and thus the ECB misses the intended target. She too favours increasing or removing the cap, after an introductory period, using the UK as an example (£10,000 to £20,000). By contrast, Angeloni (2023) thinks a cap of 3,000 euros is on the high side, given its potential disintermediation (10 per cent of bank deposits in the euro area). Banks also opt for a low upper limit: the European umbrella of cooperative banks, for example, mentions a limit of no more than €500 (EACB, 2023). It should be noted that it should not be ruled out that a maximum amount set during the introductory period will act as a “door opener,” with amounts being increased on a later date. The bill excludes interest renumeration on digital euro deposits. Here an analogy goes with cash. Its possible introduction would lead to an undesirable overlap with monetary policy (Grünewald, 2023) or to (undesirable) interest arbitrage (Angeloni, 2023). In contrast, Andolfatto (2018) and Monnet (2023) see increased competition in the deposit market as a positive element of renumeration. However, the EC has not opted for this.

Design principles digital euro

Following consultation with stakeholders, the ECB identified a number of draft principles.

Distribution model

The distribution model envisaged by the ECB assumes that supervised institutions (banks, electronic money institutions and payment institutions) take care of distributing a digital euro to the public. The front-office side will therefore be completely, so including legal and customer-related tasks, outsourced, with the ECB ensuring the settlement of payments on its central settlement platform. It is therefore not possible for citizens to open an account with the ECB, as is often thought. However, the ECB does keep track of each citizen’s balances in encrypted form, and these are shown in aggregate as liabilities on its balance sheet. The balances are visible to consumers in a digital euro app, which banks will most likely integrate into their own banking apps, although the ECB will also release a standalone app. Mooij (2023) analyses that by issuing a digital euro app, the ECB is stretching its mandate, as it goes far beyond the task of promoting the smooth operation of payment systems defined in Article 127(2) TFEU. A mandate from the legislature is needed for this. The bill provides for this.

Use cases

The starting point for the design is that all citizens will be able to pay with a digital euro anywhere in the euro area, as is currently possible with cash – between consumers, in physical shops, and also for online purchases. The ECB wants to provide an offline payment option, where consumers can pay each other without an internet connection, in a privacy-friendly manner, without the intervention of an intermediary. This usage option can be seen as the most obvious digital substitute for cash (as was also the – at the time not very popular – Dutch electronic purse, Chipknip), and can also lower the threshold for citizens who have difficulty with current digital means of payment. It can also serve as a fall back in case of system failures (Sleijpen, 2023). The bill stipulates that an online and an offline variant must be available simultaneously, starting from the introduction period. A euro will never be programmable, whereby a digital euro can only be used for specific goods or services within a certain period. This option is excluded in the draft principles (ECB, 2023a; Eurogroup 2023). The bill also excludes this. However, service providers with a digital euro can offer conditional payments to their customers (as we already know them today, e.g. via periodic direct debit payments). Customers can choose to use these themselves.

Privacy

Privacy is seen by the public as the most important aspect of a digital euro (ECB, 2022b). However, the ECB is clear: complete anonymity, as is the case with banknotes, is not a viable option. Online payments with a digital euro will be subject to the same rules as current private payment methods with prevailing anti-money laundering and countering financing of terrorism (AML/CFT) requirements. The ECB has indicated that information on payments will not be shared with the Eurosystem. For offline payments, only the funding or defunding of the offline functionality is visible to intermediaries, the payments therewith are anonymous. Mooij (2023) indicates that in this new situation, the ECB, through its central settlement platform, could have access to personal data (even if the ECB indicates otherwise). Mooij argues that in order to objectively determine that this data is protected according to applicable law, the European Data Protection Supervisor (EDPS) should supervise the ECB and national central banks. Brunnermeier and Landau (2022) also point out the need for adequate privacy governance. The bill states that privacy supervisors need only be consulted. Here, too, a risk of the “iceberg summit” (camel nose) may arise.

Funding and defunding

A digital euro app will provide users with a mechanism that converts balances from the private bank account – at the request of the account holder – into digital euros (a ‘digital ATM’), and skims amounts above the limit into the private bank account. Business owners cannot hold digital euro balances. These are converted into commercial money upon receipt – within a day.

Compensation model

The ECB has established a set of core principles for the compensation model (ECB, 2023b). For consumers, a digital euro will be free of charge. It is still unclear how intermediaries, to whom the ECB outsources distribution, can be adequately compensated for the necessary investment and operational costs. With outsourcing comes a price. Without a revenue model, there is no incentive for payment service providers to support the issuance of a digital euro (Angeloni, 2023; Grünewald, 2023; Monnet, 2023; Niepelt, 2023). The ECB assumes that merchants who receive digital euro payments from their customers will pay a fee to their payment service provider (as is currently the case for other payment methods) and that the latter will compensate the distributing banks’ costs. However, making joint price agreements on this is difficult from a competition law perspective and also presumably insufficient. If the fee merchants have to pay is higher than for other payment methods, and for the Netherlands this is likely, they will have little incentive to accept payments with the digital euro, regardless of the legal tender nature of a digital euro. Banks also point to the importance of a sound business model (EACB, 2023; EBF, 2023; ESBG, 2023).

Adoption not a given

So far, the debate on digital central banking has paid little attention to its adoption. It is certainly not a foregone conclusion, especially as it does not stem from a public demand. A survey commissioned by the ECB shows that European citizens feel they are already well served and would prefer fewer rather than more payment methods (Kantar, 2022). Recent focus group research indicates that the proposed offline variant of the digital euro is seen as innovative and attractive. At the same time, surveyed citizens doubt whether this variant will be used frequently (Kantar, 2023), although it could contribute to a low-threshold form of digital payment by less digitally-skilled citizens. Especially for the Netherlands, where the payment system is very user-friendly and of the euro area is the most efficient, the added value of a digital euro seems to be limited. Alkaya and Heinen’s final report to the House of Representatives of the Netherlands also points this out (Tweede Kamer, 2023b). Minister of Finance, Kaag, had indicated as a condition for a possible introduction of a digital euro that it should have clear benefits for consumers, companies and the economy as a whole (Tweede Kamer, 2023a). A broad (European) adoption is needed, however, to achieve the ECB’s policy goals. There is therefore a considerable challenge here.

Conclusions and recommendations

A digital euro aims to provide a widely accessible digital alternative to the declining use of cash, allowing payments to be made in the same way everywhere in the euro area. The legal tender status granted to a digital euro by the EC in its draft law supports this. After acceptance of the bill by the European Parliament and the Council of Ministers, it will be up to the ECB to decide on the issuance of a digital euro. It will have broad powers to do so, not excluding the risk of a camel nose (introducing a limited measure that later leads to heavier interventions) in some aspects (limits, privacy). If the ECB decides to do so, an introduction is not expected before 2027.

With the current draft, the ECB opts for a cautious course and perpetuates the complementarity and cooperation with the private sector that has paid off for years. Despite the fact that the ECB is not opting for a radical change in the financial stance, as seems to be the preference of some referees quoted above, the impact of a digital euro on society as a whole is far-reaching and costly.

For now, there do not seem to be sufficient incentives for payment service providers to distribute a digital euro to the public. If the added value for this public is also limited or non-existent, this creates risks for Europe-wide adoption, which is necessary to achieve the ECB’s objectives. Cost recovery of the digital euro also then remains out of the picture.

All in all, it seems too early to anticipate a final introduction of the digital euro at this time. There seems no need to do so at this moment, now that cash is still widely available in the euro area and payment service providers – at the request of the EC and ECB – are investing in European payment solutions that will lead to more harmonisation and less dependence on non-European providers. A similar conclusion is drawn by Angeloni (2023). However, the ECB – rightly – wants to be prepared for a situation in which the use of cash continues to decline. It is therefore recommended to continue researching the impact of a digital euro on the economy in the period ahead and to elaborate on the aspects mentioned above. In addition, it makes sense to take up the technical development of some use cases and organize a limited number of pilots. Payment service providers and users can then assess them for social added-value, which should be part of decision-making process for the introduction of a digital euro, in the context of the then existing and foreseeable situation.

Literature

Andolfatto, D. (2018) Assessing the impact of central bank digital currency on private banks. Federal Reserve Bank of St. Louis, Working Paper 218-026B

Angeloni, I. (2023) Digital euro: When in doubt, abstain (but be prepared). Economic Governance and EMU Scrutiny Unit, April. Available at www.europarl. europa.eu.

Bindseil, U. (2021) The future of central bank money: digital currencies? In: D. Russo, Payments and market infrastructure two decades after the start of the European Central Bank. Frankfurt am Main: ECB, pp. 292-302.

Bofinger, P. and T. Haas (2023) The digital euro (CBDC) as a monetary anchor of the financial system. Suerf Policy Note, 309.

Boonstra, W. (2019) Digital central bank money: think before you start. ESB, 104(4774), 259-261 (in Dutch).

Brunnermeier, M. and J.-P. Landau (2022) The digital euro: policy implications and perspectives. Policy Department for Economic, Scientific and Quality of Life Policies, January. Available at www.europarl.europa.eu.

DNB (2020) Digital central bank money. DNB Occasional Studies, 18-1.

EACB (2023) Digital euro. EACB Position Paper, 28 March. Available at www. eacb.coop.

EBF (2023) EBF vision on a digital euro ecosystem. Position paper, 28 March. Available at: www.ebf.eu.

EC (2023) Proposal for a Regulation of the European Parliament and of the Council on the establishment of a digital euro, Brussels, COM 369 final, 2023/0212 (COD).

ECB (2022a) Key objectives of a digital euro. ECB Blog, 13 July.

ECB (2022b, 2022c, 2023a, 2023b) Progress on the investigation phase of a digital euro. ECB Reports September, December, March and July.

ESBG (2023) A digital euro: what does it mean for savings and retail banks? ESBG Position Paper, March. Available at www.wsbi-esbg.org.

Eurogroup (2023) Eurogroup statement on the digital euro project. European Council Press release, 16 January.

Grünewald, S. (2023) A legal framework for the digital euro. Economic Governance and EMU Scrutiny Unit, May. Available at www.europarl.europa.eu.

Hofmann, C. (2023) Digital euro: An assessment of the first two progress reports. Economic Governance and EMU Scrutiny Unit, April. Available at www. europarl.europa.eu.

Houben, A. and D. Reijnders (2019) The bar for digital central bank money is set high. ESB, 104(4774), 256-258 (in Dutch).

Kantar (2022) Study on new digital payment methods. Kantar Public, March. Available at www.ecb.europa.eu.

Kantar (2023) Study on digital wallet features. Kantar Public, March. Available at www.ecb.europa.eu.

Kosse, A. and I. Mattei (2023) Making headway – Results of the 2022 BIS survey on central bank digital currencies and crypto. BIS Paper, 136.

Lelieveldt, S. (2019) The deposit bank is up for grabs. ESB, 104(4774), 262-265 (in Dutch).

Metzemakers, P. (2019) Safer money may lead to higher probability of bank run. ESB, 104(4774), 254-255 (in Dutch).

Monnet, C. (2023) Digital euro: An assessment of the first two ECB progress reports. Economic Governance and EMU Scrutiny Unit, April. Available at www.europarl.europa.eu.

Mooij, A. (2023) Digital euro’s legal framework. Economic Governance and EMU Scrutiny Unit, June. Available at www.europarl.europa.eu.

Niepelt, D. (2023) Digital euro: An assessment of the first two progress reports. Economic Governance and EMU Scrutiny Unit, April. Available at www. europarl.europa.eu.

Panetta, F. (2022a) Central bank digital currencies: defining the problems, designing the solutions. Contribution to a panel discussion at the US Monetary Policy Forum. 18 February, New York. Available at www.ecb.europa.eu.

Panetta, F. (2022b) The digital euro and the evolution of the financial system. Introductory statement to the Committee on Economic and Monetary Affairs of the European Parliament. 15 June, Brussels. Available at www.ecb.europa.eu.

Prasad, E.S. (2021) The future of money. Cambridge, MA: Harvard University Press.

Sleijpen, O. (2023) The digital euro: what and why? Opening speech for the seminar ‘Digital euro meets the Dutch experts’. 23 January, DNB, Amsterdam (in Dutch).

Tweede Kamer (House of Representatives) (2023a) Digital euro: possible design and planning: letter from the Minister of Finance, 2023-27863-136v(in Dutch)

Tweede Kamer (House of Representatives) (2023b) Final rapporteurs report on the digital euro, Committee on Finance, 27863, no 139 (in Dutch, English version available)

WRR (2019) Money and debt: the public role of banks. WRR report, 100 (in Dutch)

Auteur

Categorieën