While the deep recession triggered by the Covid-19 pandemic has battered many sectors of the Dutch economy, real estate markets – to the surprise of us and many others – have shown remarkable resilience. In a recent paper we take a closer look at the residential and commercial real estate markets in the Netherlands, identify risks and challenges and suggest some policies to address them.

Rising prices

The rise in residential real estate prices, i.e. houses occupied by their owners, has barely been interrupted by the recent crisis, with low interest rates, favorable tax treatment and longstanding supply bottlenecks supporting the trend. The prices of commercial properties, such as offices, shops, or large blocks of rental flats, have also sustained their ascent, notwithstanding a turn in the investment cycle, a pick-up in vacancy rates and accelerated structural shifts in multiple market segments, especially in retail where e-commerce has further encroached on bricks-and-mortar businesses.

Higher house prices have been a boon for commercial real estate by lifting the prices of rental dwellings, a large part of the market. However, they have also contributed to waning housing affordability and soaring rents. Some parts of the population are confronted with expensive rentals, e.g., if they are ineligible for rent-controlled accommodation, subject to long-waiting lists for social housing, and unable or unwilling to buy a property. This eats into their disposable incomes and sharpens inequalities.

Risks and challenges

Elevated real estate valuations are raising concerns (figure 1). Price increases for residential structures have outpaced the rise in rents in recent years, boosting valuations. Activity in commercial real estate markets has been brisk with investment appeal partly supported by low safe-asset returns. Yet, valuations are susceptible to rising interest rates and disappointing rental expectations post-pandemic.

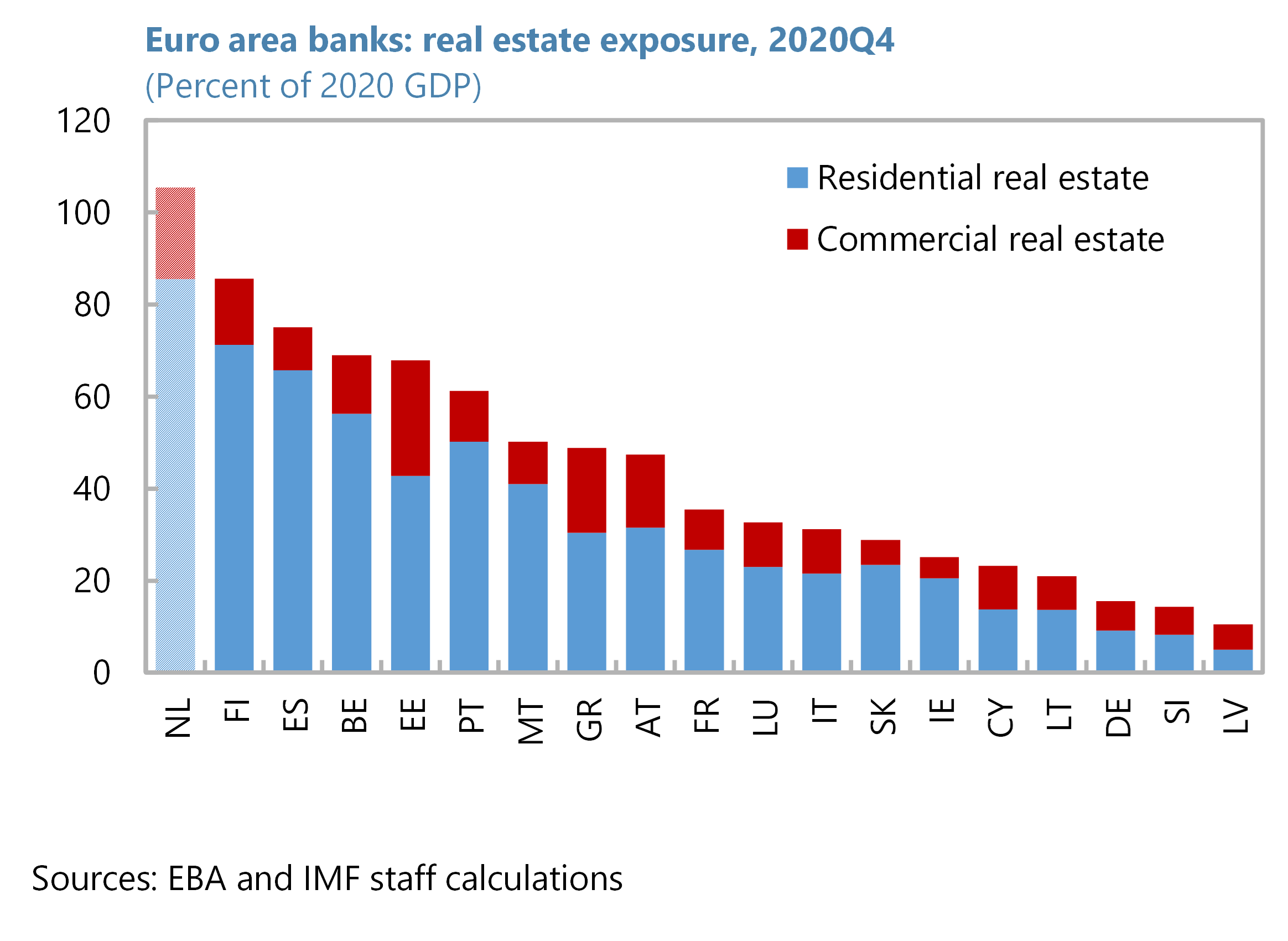

In comparison to other euro area countries, the Dutch financial sector maintains large real estate exposures (figure 2). As a consequence, a protracted price correction entails risks for financial stability. Weakening balance sheets and capital positions of financial intermediaries during periods of stress could result in a tightening of funding conditions, thereby dampening economic activity. At the same time, however, latest stress tests of the financial system indicate considerable resilience to potential real estate-related strains (DNB, 2020a; 2020b; 2021), also due to the strong track record of mortgage loan performance even during difficult times.

A further layer of risk is added by high household indebtedness, jeopardizing capacity to service debt or, more likely, to maintain consumption if there were a new crisis episode. Moreover, the various participants in real estate markets maintain an extensive network of business and financial links which has the potential to transmit stress among a small set of actors to the rest of the economy. Data limitations hampering comprehensive analysis, particularly in the commercial real estate segment, are an aggravating factor that raise uncertainty about some of these risks.

Macro-financial risks are compounded by long-standing structural challenges. Housing market rigidities abound, with the subsidization of social and owner-occupied dwellings playing a determining role by enabling rents at below market-clearing levels for the former and offering an attractive tax treatment of the latter. Indeed, the income tax system embeds incentives toward homeownership and its financing via debt.

At the same time, various barriers are hampering the supply of residences, such as a preference among municipalities for owner-occupied rather than rental housing, spatial constraints and zoning restrictions, or a lack of planning capacity.

Commercial property has been affected by already high rates of digitalization of the economy that have been reinforced by the pandemic. Additional offices, shops or hotels may suffer obsolescence if remote working stays widespread, e-commerce continues flourishing and business travel remains subdued.

Policy recommendations

The Dutch authorities have shown awareness of the risks and weaknesses of real estate markets and have taken action by, for instance, discouraging highly leveraged mortgage borrowing by means of macroprudential policy measures and adjustments to tax incentives or by mandating banks to build buffers against a downturn in house prices. Still, policymakers should actively keep working towards tackling the multitude of challenges that remain.

Specifically, supervisory policies concerning residential real estate exposures could be tightened further, also by extending their reach to non-bank financial institutions. Generous borrowing limits to address affordability issues for e.g. first-time buyers appear second best. Likewise, tax reform may consider a more level treatment between owner-occupied and rental housing, for example by gradually raising imputed rental income from owner-occupied housing or shifting the taxation of such housing to Box 3 (Klemm et al., 2021). To address housing supply shortages, rent controls, planning incentives and capacity as well as building and zoning criteria should be reviewed.

Concerning commercial real estate, data gaps should be closed with expediency to allow a comprehensive assessment of risks and challenges. In addition, policy options to counter financial sector vulnerabilities should be investigated, with measures deployed towards residential mortgage exposures potentially serving as a template.

The views in this piece are the authors’ own, and do not necessarily represent those of the IMF.

Literature

DNB (2020) A Pandemic Stress Test for the Dutch Banking Sector. Financial Stability Report, pp. 105-117.

DNB (2020b) Downturn in the Commercial Real Estate Market. Financial Stability Report, pp. 87-92.

DNB Commercial Real Estate: An Updated Pandemic Stress Test for the Dutch Financial Sector. Financial Stability Report, pp. 17-20.

Klemm, A. S. Hebous, S., and C., Waerzeggers (2021) Capital Income Taxation in the Netherlands. IMF Working Paper No. 21/145.

Auteurs

Categorieën