Consumers have a need for safe money. A deposit bank and central bank digital currency are safe alternatives for payment service users who do not want to place their money with a traditional bank. But what are the consequences of these alternatives for the entire banking sector?

In brief

– With a deposit bank or central bank digital currency, the role of the central bank in the financial system increases.

– In times of crisis, a deposit bank or digital central bank money can increase the size of bank runs.

With the increasing dominance of scriptural money and the disappearance of public payment and savings options, consumers have become increasingly dependent on commercial banks to make payments. This leads to inconvenience for consumers, as bank deposits are exposed to credit risk, which means that their money is not necessarily safe.

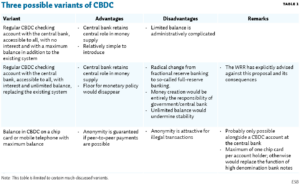

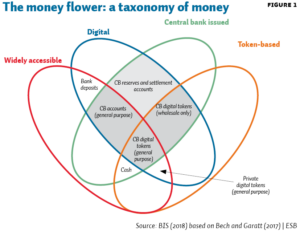

Since the financial crisis, many proposals have been launched in the public debate to make payment transactions safer and consumers less dependent on commercial banks. A possible solution is to give consumers digital access to the central bank’s balance sheet, in addition to banknotes in circulation. This can be done via a payment account directly with the central bank or via the issuance of digital central bank currency (CBDC), as the Swedish Riksbank intends to do with the e-krona (Sveriges Riksbank, 2018).

Box 1 – Deposit bank a difficult business case

A depository bank is an extreme example of narrow banking, a business model that economists have proposed in the past to drastically reduce a bank’s risk of bankruptcy. In essence, narrow banking means that a bank does not grant risky loans for its own account, but invests its deposits in very safe and liquid government bonds or central bank reserves.

In the case of a licensed deposit-taking bank, the deposits are only remunerated at the interest rate on central bank reserves. This means that it can offer its account holders at most the interest rate on the central bank deposit facility, less a deduction for operational and balance sheet costs. In the current situation with a negative interest rate on the deposit facility of -0.4 per cent, it should therefore charge a fee for holding savings, or charge sufficient commissions on payment transactions it carries out.

But even with a positive interest rate on central bank reserves, a depository bank would be at a disadvantage compared to commercial banks. These banks can earn a maturity and credit risk premium on their exposures, which they can then pass on in part to depositors. Because of the business model – and regardless of the interest rate on central bank reserves – the maximum interest rate that a depository bank can offer, without incurring a loss, is never higher than that of commercial banks.

The cost disadvantage of a deposit-taking bank means that, in general, it is not very appealing for retail customers. Only very risk-averse account holders who are willing to accept a lower interest rate, or even to pay for a payment account, will switch. After all, most account holders with commercial banks are already safe to some extent: their deposits of up to EUR 100,000 are guaranteed by the Deposit Insurance Scheme, which protects more than 90% of the deposits of retail customers. In addition, most customers are not inclined to switch banks (Van der Cruijsen and Diepstraten, 2015), although this may change with the introduction of a depository bank. Moreover, even a depository bank is not completely safe: there is a small chance of bankruptcy due to fraud, mismanagement and unforeseen external factors.

Another example is a depository bank, a private bank whose sole function is to offer payment accounts to customers and which therefore does not grant credit to third parties (Van der Linde, 2015). The deposited funds are deposited with the central bank. Because a depository bank, unlike a traditional bank, does not provide business loans and residential mortgages, it does not expose itself to credit and maturity risk. Therefore, a depository bank cannot fail due to defaults by borrowers. This makes it a safe alternative to a traditional bank from the perspective of account holders.

Despite the need for safe checking accounts, such alternatives do not yet exist. Nevertheless, it is useful to understand the dynamics that these initiatives can trigger in the banking sector as a whole.

Because of the connection with other banks, a depository bank and digital central bank money are more than just a safe digital vault, which has consequences for central bank intermediation, central bank interest rate policy and financial stability. The remainder of this article focuses specifically on the depository bank, but the arguments also applies to digital central bank money (Barrdear and Kumhof, 2016), with the exception of the business case for the depository bank in Box 1, of course.

Intermediation

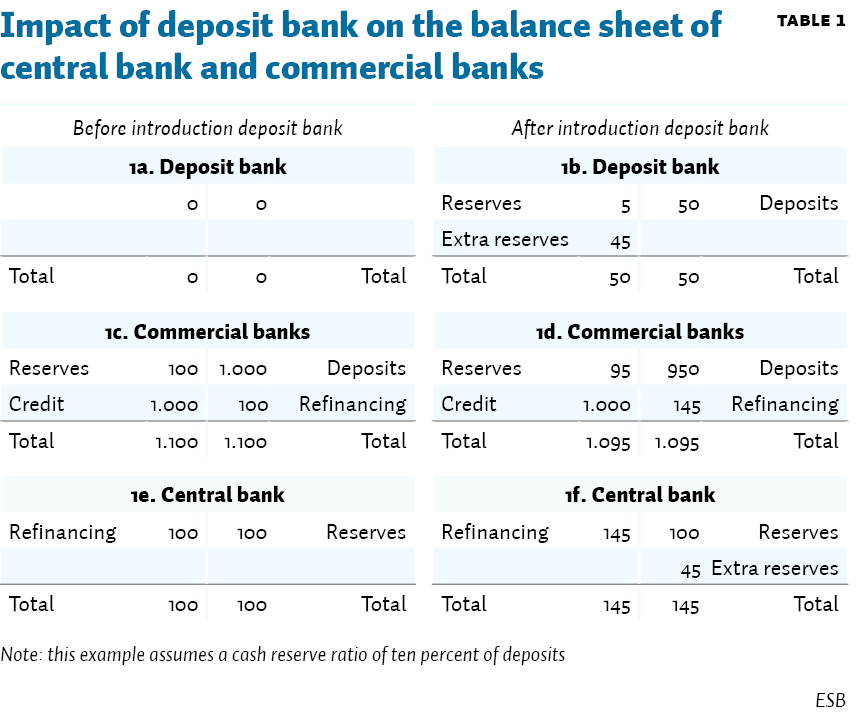

A depository bank will lead to more intermediation by the central bank. This is because a deposit-taking bank withdraws deposits from the commercial banking system in the same way as an increase in the demand for banknotes does. The stylised balance sheets of the depositary bank, commercial banks and the central bank in Table 1 show this. After its inception, part of the deposits with commercial banks flows to the depository bank (Table 1a(b)). To the extent that this leads to a liquidity shortage in commercial banks, the demand for short-term bank funding will increase (Table 1c(d)) and money market interest rates will rise. As part of its monetary policy implementation, the central bank meets this demand through its (collateral-based) refinancing operations, allowing banks to meet the cash reserve requirement flexibly and steer overnight interbank rates to the desired level (Table 1, f).

In the end, the central bank finances a small part of the loans from commercial banks, and the central bank’s balance sheet has increased. The size of this increase is equal to the amount that the depository bank deposits in additional reserves on the deposit facility. The central bank thus de facto mediates between the depository bank and the commercial banks, whereas one of the European Central Bank’s principles is that financial intermediation should, as much as possible, take place in the market.

Interest policy

In a scenario of calm market conditions, it is likely that a deposit-taking bank will only raise a relatively small amount of deposits, due to its cost disadvantage. The central bank can accommodate the liquidity leak with its operational framework, allowing it to continue to steer interest rates to the desired level. However, the higher asset constraint will increase banks’ funding costs. It is also conceivable that, when the flow of money to the depository bank is likely to increase, banks will offer higher interest rates on deposits. This may also lead to higher lending rates and reduce the demand for credit. This raises the question of whether the central bank should take this into account in the setting of its monetary policy, for example with a lower policy interest rate. However, the basic mechanism of monetary policy will not change (BIS, 2018).

Financial stability

A systemic crisis, in which confidence in the entire commercial banking system is significantly reduced and the depository bank is seen as the only safe alternative, may trigger larger deposit flows. While deposit insurance will limit outflows, there is a risk that herd behaviour leads to a bank run (Brown et al., 2014).

During a systemic crisis, the ability of consumers to deposit unlimited amounts of money with the central bank via a depository bank is therefore the Achilles heel of the banking system. A run on deposits would then be much easier than in the current situation where customers only have payment services from traditional banks and only have the possibility to convert their deposits into banknotes. On balance, therefore, the banking sector is becoming less stable and credit is becoming relatively scarce and more expensive (Bossone, 2001).

It should be noted that the risk of a non-cash bank run could, in theory, also disciplines banks when it comes to taking balance sheet risks. If this happens, they will have to transform their business model into something more like of a depositary bank, and compete on safety and not on costs.

Conclusion

A depository bank and central bank digital currency can provide a safe haven for households and non-financial businesses. Once introduced, these alternatives are part of the current financial system – they are inextricably linked to the rest of the banking system. The possibility of unlimited deposit transfers from commercial banks to a safe haven poses a risk to financial stability and has consequences for the implementation of monetary policy. Of course, this risk can be mitigated, for example by limiting transfers in times of crisis. But that denies the consumer exactly what he was interested in: a choice for safety when it matters.

References

Barrdear, J. en M. Kumhof (2016) The macroeconomics of central bank issued digital currencies. Bank of England Working Paper, 605.

BIS (2018) Central bank digital currencies. Committee on payments and market infrastructure en markets committee. Bank for International Settlements. Available at www.bis.org.

Bossone, B. (2001) Should banks be narrowed? IMF Working Paper, 159.

Brown, M., S.T. Trautmann en R. Vlahu (2014) Understanding bank-run contagion. ECB Working Paper, 1711.

Cruijsen, C.A.B. van der, en M. Diepstraten (2015) Banking products: you can take them with you, so why don’t you? DNB Working Paper, 490.

Linde, R. van der (2015) Verbeter de financiële sector en begin een bank. Blog on www.ftm.nl, June 15, July 3 and August 26. For the introduction of deposit bank10

Sveriges Riksbank (2018) The Riksbank’s e-krona project – Report 2. Available at www.riksbank.se