The Netherlands Scientific Council for Government Policy (Wetenschappelijke Raad voor het Regeringsbeleid, or “WRR”) is recommending that people should be given a checking account with the central bank. However, this may have far-reaching consequences for both financial stability and the position of the Dutch central bank (DNB). Is the WRR really aware of the consequences of its advice?

In het kort

– The introduction of central bank digital currency (CBDC) represents a radical change to the financial system;

– CBDC would be expensive, it may undermine financial stability, and it would require a new structure for banking supervision in the Netherlands; and

– Would the benefits of CBDC outweigh the disadvantages?

The Dutch payments transfer system operates virtually faultlessly, is among the most cost-effective in the world, and is extremely stable. Even during the financial crisis, it functioned perfectly. Moreover, it is an important source of innovation in the field of payments. For instance, the Netherlands, along with Sweden, is leading the way when it comes to contactless payments. So there would seem to be little reason to make radical changes to the current system.

But this is exactly what the Scientific Council for Government Policy (Wetenschappelijke Raad voor het Regeringsbeleid, or “WRR”) is proposing in its report titled Geld en schuld (Money and debt) in January 2019. The WRR is explicitly recommending that every Dutch citizen should be given the opportunity to hold a payments account with the central bank. It talks about “creating a digital equivalent of cash” (WRR, 2019, p. 237). At first sight, this might not seem to be particularly radical, but further consideration shows that it could have serious consequences for the stability of the banking system and the position of the central bank.

Central bank digital currency, or CBDC, is cashless money (money held in bank accounts) that is held in an account at the central bank. CBDC does not yet exist anywhere on a large scale, although there are central banks that offer payment services to some non-financial institutions on a limited scale. With its e-krona project, the Riksbank of Sweden is the central bank actually most involved with CBDC. But in Sweden too, final decisions still have to be made in this respect (Riksbank, 2018).

The main consideration behind the e-krona project is the rapid decline in the use of cash in Sweden, increasing the possibility that cash money, banknotes and coins in circulation, would entirely disappear, as a result of which the central bank would no longer have a role in retail payments traffic. This is seen as undesirable in principle. The situation in the Eurozone is, however, nowhere near this point. The Dutch situation, in which the use of cash has already been overtaken by ‘cashless’ money, is not illustrative for the Eurozone, as in most other member states cash is still king. Were CBDC to be introduced in the Netherlands, it would be in addition to the existing money-in-circulation system, including the euro notes and coins, which of course have an EMU-wide circulation.

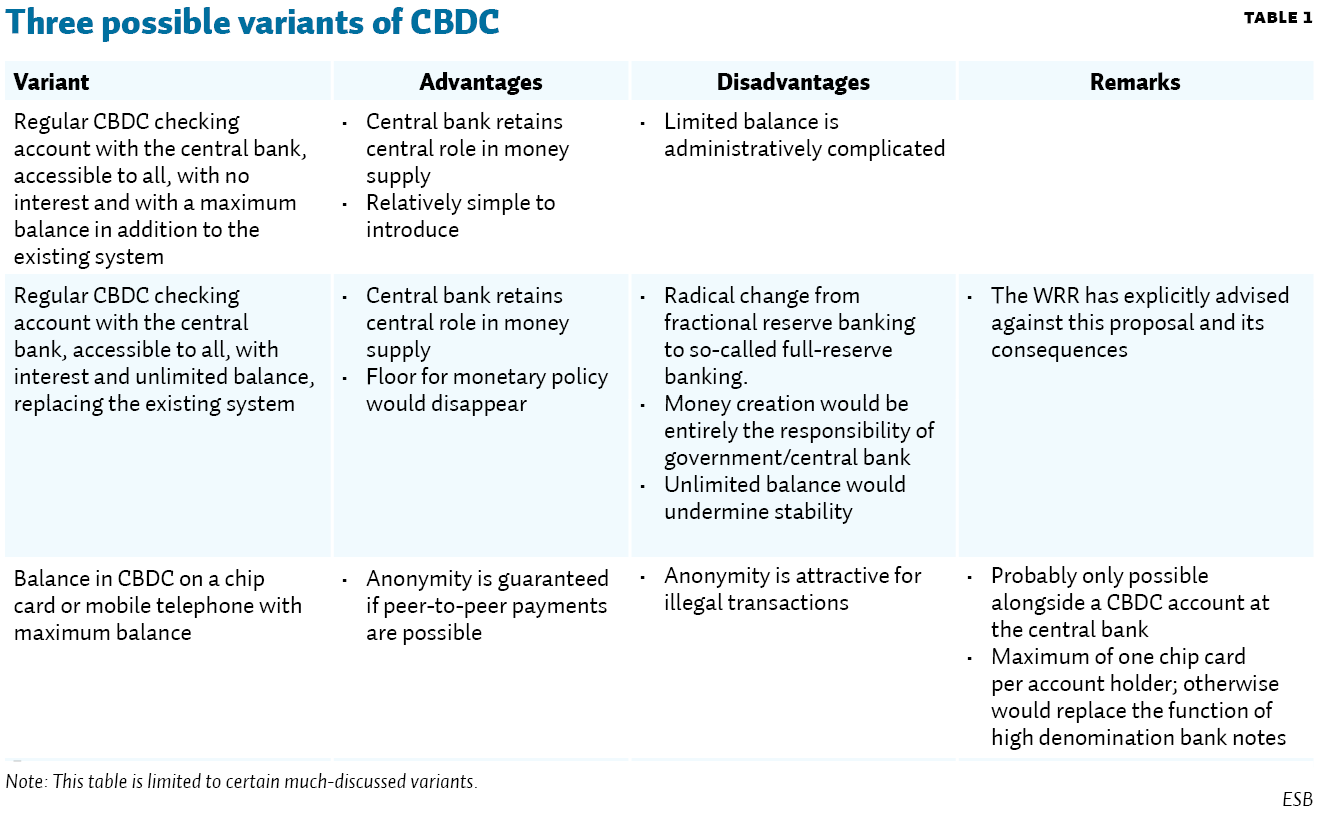

There are many variants of CBDC. I will restrict myself here to those that are technically feasible in the short term. This means a checking account based on existing technology as an addition to the existing system. Blockchain technology is not yet suitable for the handling of mass payments. The speed of a bitcoin transaction for example is measured in minutes. Normal funds transfer traffic handles thousands of transactions in a single second. A non-exhaustive list of the possibilities is given in table 1. For further detail, see the literature on this (BIS, 2018; Riksbank, 2018).

CBDC versus bank notes

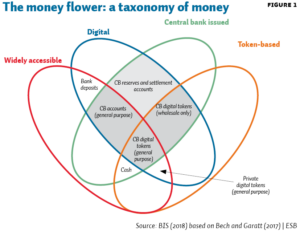

According to the Bank for International Settlements (BIS), the multitude of possibilities available means that it is only possible to define CBDC by what it is not: “CBDC is a digital form of central bank money that is different from balances in traditional reserve or settlement accounts” (BIS, 2018, p. 4). The BIS observes that central banks traditionally issue digital money in the form of bank reserve accounts. The most important correspondence between CBDC and a bank note is that both represent a liability of the central bank. One of the differences is that a payment with a banknote is completely anonymous, while a payment through a checking account by definition is not. To give CBDC the same degree of anonymity, the checking account would have to be supplemented with a value-based token allowing peer-to-peer transactions to be effected.

Formerly, it was not unusual for businesses to hold a payments account with the central bank. The central banks have gotten rid of these relationships over time, however, in order to focus on their role as the pivot of the financial system. Another consideration was that it was not logical for central banks to supervise institutions with which they were in direct competition. I will return to this point later on.

As said, the central bank could decide to supplement a CBDC account with a value-based token. This could, for instance, be a balance on a chip card or mobile telephone. For a CBDC payment to be equivalent to a cash transaction, it is important that one can effect peer-to-peer transactions by this means, or make payments from one token to another without the need for a payment instrument. Although ultimately this version is not completely anonymous, it goes a long way towards meeting the preference of many people for a degree of privacy with respect to the transactions they effect. In its e-krona project, the Riksbank of Sweden is suggesting to offer such an option up to a maximum of perhaps SK 250 per chip card (Riksbank, 2018).

It would also be possible to set a maximum for the balance that people could hold in their CBDC account. This has certain advantages from the point of view of stability (see below), but it would also bring the disadvantage that the administration would be complicated. One of the complications is that it may result in a market in available limit space, if people with a low balance in CBDC were to sell the remainder of their available limit to parties wishing to hold more CBDC than is officially permitted (Riksbank, 2018). This could create new risks in the system.

There are indeed many different potential variants, which are discussed in more or less detail in the relevant literature. The following addresses some of the aspects of CBDC that so far have received relatively little attention.

Financial stability

The WRR is recommending that CBDC should be introduced as a supplement to the existing system. It would then circulate alongside the existing money (both cash and money in bank accounts) in circulation. One important disadvantage is that this would likely have a negative effect on financial stability. The existence of CBDC would make it very simple for people to transfer money from a regular checking account with a commercial bank to their CBDC account with the central bank. We are then talking about a digital bank run. While the threat of a run on the banks in the current system is always present, given their role in maturity transformation, the consequences in today’s system are more limited. The most common manifestation of a bank run is either that people withdraw cash from their bank account or, more often, that people and companies transfer money from their accounts at a bank perceived to be in difficulties to another bank considered to be safer. Professional capital providers can also rapidly withdraw money from one bank and transfer it to another. The banks under pressure then have a liquidity problem, but the liquidity of the banking system as a whole is, apart for the cash withdrawal, not affected. If, on the other hand, a run on the banks occurs via CBDC, it will not only be the banks in difficulty that have this problem, but the liquidity of the banking system as a whole will be reduced. In other words, a run on the banking system as a whole would be easier with CBDC, as a result of which the consequences for the liquidity of the banking system would be more serious and escalation would be more likely.

The central banks are thoroughly aware of this threat. However, the WRR thinks that the existence of a deposit guarantee scheme would provide adequate protection (WRR, 2019). But would this really offer adequate protection if people could transfer their balances to a CBDC account at the central bank in a matter of seconds? In any case, they could avoid the uncertainty with respect to the time it would take to activate the deposit guarantee system. The WRR also asserts that CBDC would in this way enforce discipline on the banks, in the sense that they would see themselves as forced to fund themselves more with long-term capital and equity. The WRR accordingly takes a rather flippant view of the role of the banks in financial intermediation –which has great relevance to society, but by definition create liquidity risks– and the associated transformation of maturity. DNB has more concerns regarding the negative effects of CBDC on financial stability than the WRR (DNB, 2018).

With or without interest?

One possible advantage of CBDC, in the context of the absence of cash, would be that a negative interest rate could be applied. This would open the possibility of working with negative policy interest rates, thus eliminating what is known as the Effective Lower Bound (ELB) (Rogoff, 2016). This would allow for a negative real policy interest rate to be created in a low or negative inflation environment. If the central banks expect to need this instrument in due course, if CBDC is actually introduced it would be sensible to include the possibility of interest (either positive or negative) being due right from the start.

The European context

If DNB were to introduce CBDC in the Netherlands, it would be denominated in euros. Currently, cash money in circulation in the eurozone is regulated by the European Central Bank (ECB). One might reasonably expect that a Member State would have to obtain permission from the ECB if it wishes to introduce CBDC. CBDC is after all, like bank notes, a liability of the Eurosystem. If, for example, the Eurosystem considers that CBDC will sooner or later play a role at the European level, it would not be sensible for individual central banks to start this on their own initiative, with the risk that they would have to opt for a different variant and/or technology at a later date. This requires harmonization, yet the WRR’s report does not really discuss the international context.

Supervising the supervisor

If every resident has access to CBDC, this would mean that the central bank (like the commercial banks) would be responsible for continuous monitoring of the payments system to prevent illegal transactions being effected. For example, it would have to know all its customers, in the Netherlands potentially 17 million of them, and know where their money comes from. In formal terms, it would have to meet all regulation in the field of Anti-Money Laundering and Due Diligence. This would require investment in customer and compliance departments and possibly even a branch network for the central bank, which today has only one office. This immediately raises the question of which agency would monitor the central bank to see that it was doing its job adequately. Not only that, people could ask whether it would still be appropriate for DNB to continue to supervise the payments traffic conducted by the commercial banks (known as ‘oversight’). It is quite possible that a new supervisor would have to be created, or that the Financial Markets Authority (AFM) would have to supervise DNB.

Cost

The aspect of cost has hardly received any consideration so far in the debate. Maintaining and securing a large-scale payments system is expensive. For each major bank, and so also for DNB, this can easily amount to hundreds of millions of euros per year, if not more. This could also be at the expense of the transfer of profit to the Dutch government, and could therefore be an issue in the political debate on the government budget. In theory, the central bank could cover its costs from seigniorage (profit made by a government for issuing currency), although it is doubtful whether this would be allowed under the European agreements. It is however essential that the central bank should not be subject to any political budgetary restriction in this respect, since inadequate maintenance and/or security of a retail payments system set up by the central bank could entail serious risks for the financial system. Indeed, as an issuer of CBDC, DNB would be by far the most systemically relevant bank in the Netherlands, and also most certainly ‘too important to fail’.

Conclusion

From the WRR report, one can conclude that the Council is arguing for CBDC in the form of an account at the central bank based on existing technology. But the possibility of peer-to-peer transactions will have to be offered as well as a card-based variant if it is to work like a bank note. However, as long as there is cash money in circulation, which in the Eurozone in the foreseeable future will be the case, we do not actually need this option.

So we are left with the question of whether the alleged benefits of CBDC outweigh the not insignificant costs and other disadvantages. As already mentioned, the current payments traffic system functions more or less perfectly. Not only that, it is likely that the introduction of CBDC would require a redesign of banking supervision and Europe-wide harmonization. The main question to be answered therefore is whether we in the Netherlands should spend hundreds of millions of euros or more per year on a product that delivers virtually no new services, complicates the position of the central bank, has the potential to undermine financial stability and will force us to redesign our supervisory structure. Certainly there is enough evidence to think over whether or not this makes sense.

References

BIS (2018), Central bank digital currencies, March. Bank for International Settlements, Committee on Payments and Market Infrastructures. Available at www.bis.org.

DNB (2018), 2017 Annual Report. Amsterdam: De Nederlandsche Bank.

Rogoff, K.S. (2016), The curse of cash. Princeton: Princeton University Press. Riksbank (2018) E-krona project, report 2. Sveriges Riksbank. Report available at www.riksbank.se.

WRR (2019), Geld en schuld: de publieke rol van banken. WRR report, 100.