In brief

– Antitrust and regulation must begin with an exploration of the various forms of competition that moligopolies face.

– Moligopolies are conglomerates that all have a core business.

– A moligopoly is different from a monopolist because of fierce four-dimensional competition.

This article is based on Petit (2016) and draws from a forthcoming book Petit (2019)

In virtually every country, antitrust agencies and regulators characterize US tech giants as monopolists. The press now refers to them as ‘big tech’, the ‘frightful 5’, or FAANGs (for Facebook, Apple, Amazon, Netflix and Google). Do they deserve to be vilified as monopolists regulated like public utilities or even broken up?

Antitrust and regulatory agencies say FAANGs are monopolies. Other observers, including FAANGs themselves, consider digital markets as intensely competitive. What if both were right? This intuition, which I present in Petit (2016) and discuss in a forthcoming book is what I call the moligopoly hypothesis. This is the idea that FAANGs – or perhaps just a few of them, with the possible addition of Microsoft – are at the same time monopolists and oligopolists.

To explore that question, in Petit (2016) I investigate two sources of data. First, the yearly 10K reports filed by the tech giants before the US Securities and Exchange Commission (SEC) give reliable evidence on the competitive environment and risk factors faced by each FAANG. Second, the ‘market research’ produced by financial data providers, embodies useful company and competitor profiles information. Both datasets support the moligopoly hypothesis. They offer a new picture of the FAANG firms’ competition. One in which each FAANG takes competition from other FAANGs, non-FAANGs (like AT&T, DELL, IBM and Oracle), foreign tech firms (like Spotify, Baidu and Tencent), and related companies (like Facebook versus Instagram or Google Maps versus Google Waze). Once this is understood, it is possible to see a lot of variations across FAANGs, and doubts that one-size-fits-all regulatory proposals are in order.

The nature of moligopoly competition

How do moligopolists actually compete, is the next logical question. The data, again, suggests that FAANGs display four features, though there are significant discrepancies at firm level.

First, FAANGs are conglomerates. All have a core business: Apple in hardware, Amazon in online retail, and Google in search engines. But all also have a diversified portfolio of activities. Some, like Amazon, Microsoft or Google, cover a wide scope of products and services. Others, like Facebook or Netflix, are less spread out. Sometimes, FAANGs vertically or conglomerally integrate through the mergers and acquisitions (‘M&A’) market, for instance with Google and Android, Facebook and WhatsApp or Microsoft and LinkedIn. In other cases, FAANGs expand by internal growth, like Amazon into cloud, Apple into watches and Netflix into media content.

Second, FAANGs characterize uncertainty as a source of intense competitive pressure. The FAANGs’ concern is specifically on technological uncertainty, not on disruption caused by other factors like currency fluctuations, demand shocks or trade wars. Admittedly, technological uncertainty belongs to FAANGs own DNA. Most, if not all of them, leveraged technology to disrupt incumbent players perceived as unassailable monopolists.

Third, FAANGs channel high amounts of financial and human resources into research and development (R&D). More precisely, some FAANGs show unusually high R&D intensity levels (i.e. the ratio of R&D expenses to revenue) in excess of the orders of magnitude observed in other R&D hungry sectors like defense or pharmaceutics.

Fourth, FAANGs’ competitive strategies display a degree of serendipity. Innovation strategies are a case in point. In parallel to outcome-driven R&D processes, some FAANGs follow blue-sky research processes designed to achieve unpredictable outcomes through experimentation. Microsoft Sky Blue, Google Research/Google X or Facebook’s Building 8 divisions are possible illustrations.

Sometimes, successful innovation occur out of any institutional framework: Amazon almost involuntarily developed cloud services. Similarly, a degree of serendipity characterizes the FAANGs’ product launch strategies. Google Maps, the Apple Store or Netflix’s streaming were all introduced without any clear monetization strategy. And when products fail, exiting the market is promptly decided, for example as with the smartwatch Microsoft Band.

Interpretation

Are these structural features the cause or the effect of a specific model of competition particular to the moligopolists? One that would distinguish FAANG firms from the average tendencies displayed by monopolies, as evidenced from past or contemporary industries.

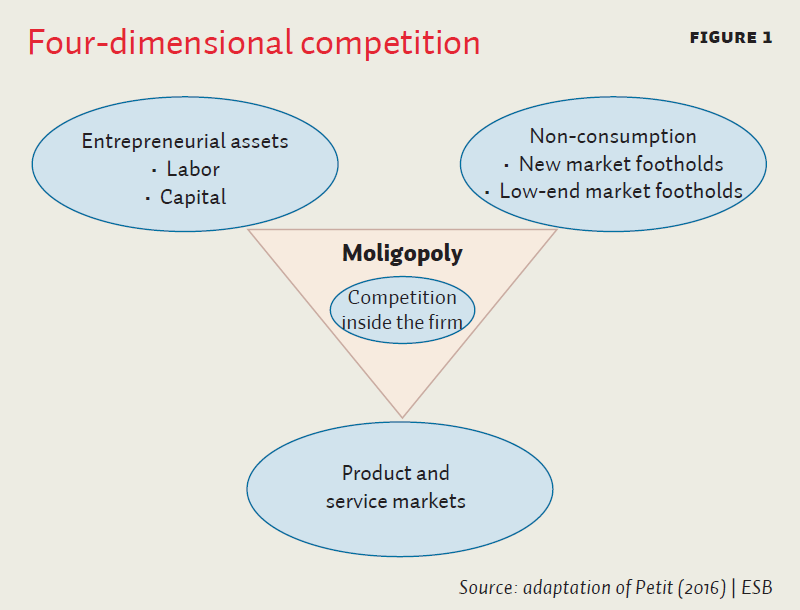

The answer to this question is that moligopolists participate in a four-dimensional competitive process (figure 1). First, moligopolists compete as rival sellers of substitute products or services in a multiplicity of product or service markets, like mobile payments, cloud computing, games or messaging are obvious examples. But contemporary antitrust and regulatory policy focuses on this first dimension of competition only, and neglects other dimensions of rivalry in the competition for new markets, for cooperation in entrepreneurial assets and the competition inside the firm.

Competition for new markets

As a second dimension to competition, FAANGS compete against the ‘non-consumption’. Competition against the non-consumption often leads moligopolists to compete against other FAANG and non-FAANG firms.

The concept of ‘competition against the non-consumption’ is an invention of Business-Strategy Professor Clay Christensen (better known for his work on the theory of disruptive innovation). The key point made by Christensen is that some firms essentially try to serve potential purchases that are not made by customers, because existing products or services are ‘too expensive or too complicated’ or try to deliver ‘new market applications for entirely new customers’.

The notion of ‘competition against the non-consumption’ is very apt to capture the competitive dynamics at play in moligopoly markets. Unlike monopolies which do not worry about unserved, and often unseen, segments of market demand, moligopolies go after the non-consumption in new markets. Think for instance of competition in cloud computing (Amazon, Microsoft and Google), self-driving cars (Google and Apple), virtual reality devices (Microsoft, Facebook), wearables (Google, Microsoft, Apple) or space transportation (Google, Amazon, Facebook). This process often brings the moligopolists to mimic one another. When one moligopolist discovers a potential new market foothold outside of its core activities, other moligopolists tend to follow suit. This imitation game is suggestive of an urge to keep the iron in the fire, and of the ability to ‘hop’ to the next (disruptive) ‘dominant design’ in case a rival tech giant would be the first to discover a viral technology application.

In parallel to the search for new market footholds, moligopolists also attempt to disrupt incumbents’ economic rents in low-end footholds. In this variant, moligopolists try to resegment markets where incumbent suppliers perform poorly in price or non-price terms. Zero price offers like Amazon Prime, WhatsApp or Gmail are possible instantiations.

In both cases, moligopolists exploit the relatively low marginal costs that characterize the supply of intangible goods and services. The challenge for them is then to cover the large fixed and sunk costs necessarily incurred upon entry. This long term horizon issue requires moligopolists to solve hundreds of highly complex scalability problems. Google, Facebook and Amazon spent hundreds of millions of dollars scaling Android, Instagram and Prime. Networks effects certainly help, but many platforms fail to ‘ignite’ due to crummy design or poor monetization choices. Moreover, established platforms may go under due to demand shocks. It is often forgotten that network effects cut both ways, as Yahoo!’s demise reminds us. Also, digital firms are exposed to unanticipated variable costs. Indeed, regulatory requirements like protective privacy regimes or content moderation rules are labor intensive.

The general take away from the above discussion is that entrenched market positions in the core are just one slice, layer or facet of the various dimensions of competitive interactions amongst moligopolists.

Competition for cooperation in entrepreneurial assets

A third dimension of competition is for cooperation in entrepreneurial assets. This competition can be seen on the demand side of the labor market and on the supply of side of capital markets.

Take labor markets. SEC filings data show that job growth in FAANG has approximated job growth in the high-tech sector over the past few years. The US Bureau of Labor Statistics also recently reported that high tech workers are paid well above those not engaged in high tech. This percolates through all employee ranks. Not only are engineers paid more, but sales reps, managers and administrative staff earn wage premiums of between 8 and 48 percent. Last, but not least, data shows that employees at Amazon and Google have among the lowest job tenures of Fortune 500 companies, indicating the job churn that characterizes a vibrant, competitive industry.

Or consider capital markets. The moligopolists M&A activity on transactional markets can be seen as a declination of moligopoly competition for entrepreneurs, through waves of ‘acqui-hiring’. Additionally, the moligopolists engage in corporate venture capital (CVC). Well-known examples include Google ventures of $258 million and Microsoft venture of $1 billion investments in Uber, Microsoft’s $240 million investment in Facebook in 2007, Google-led $524 million investment in MagicLeap.

The bottom line is: some moligopolists look like Schumpeterian social institutions which incentivize, finance and structure the efforts of entrepreneurs through which competitive disruption occurs.

Competition inside the firm

Finally, some moligopolists also embody a degree of internal rivalry at subsidiary, division or business unit levels: Google has Waze and Maps, YouTube and Play Music; Microsoft has Word and Works or Mojang and Studios.

Outside of the US, tech firms also institutionalize competition. China’s Tencent is a good example. It initially had a messaging app called QQ. It then introduced a competing service called WeChat which eventually disrupted QQ. However, the QQ service was maintained. Both now compete against each other, though each with a distinct focus.

This rivalry is distinctive. Competition economics perfectly well understands how vertically integrated platforms compete with third-party sellers (like Amazon’s competition against merchants) or with related firms in which they have a stake (for instance, Google’s driverless car subsidiary Waymo’s competition against Uber). By contrast, existence of internal rivalry violates economics’ first principles. Nobel Prize economist Ronald Coase showed that some firms exist to avoid the transactions costs encountered on markets. Why do moligopolies incur internal transaction costs resulting from the competitive process, when they could substitute this by costless hierarchical control? Perhaps, serendipitous innovation is an explanation.

The problem with competition policy

As said before, contemporary antitrust and regulatory policy pays almost no attention to the second, third and fourth competitive dimensions of moligopoly competition outlined above. Why?

The problem here is not one of ideology, it is one of methodology. In decision after decision, the common thread in all antitrust regulatory agencies’ investigations is to measure competition by reference to a relevant market. On its face value, this preliminary step called ‘market definition’ is legitimate. Its practice, however, is much less satisfactory. Market definition lends itself to risks of gerrymandering. Or the idea that if antitrust watchdogs draw markets narrowly enough, every company can be made to look dominant. In the 2018 Google Android decision, the European Commission said that Google Android was dominant on the market for ‘licensable smart operating systems’, excluding Apple from the relevant market because iOS is a proprietary system not licensed to other phone makers. This is akin to saying that Airbus is a monopolist. True, Airbus sells 100 percent of a unique product: a double deck aircraft. But Airbus also faces dog eat dog competition from Boeing.

Moreover, the systematic assessment of competition in the context of a relevant market handicaps the antitrust and regulatory decision makers’ ability to think about the social costs and benefits of cross-market competitive injuries or efficiencies. The questions are simple: can conglomeral integration without a dominant position reduce competition? Should we redeem competitive injury in one relevant market on the ground that it is outweighed by efficiencies in some or all other markets? Failure to look at these issues is antithetical to antitrust and regulatory decision makers’ commitment to evidence-based policy. And in practice, it is likely to lead to false convictions and acquittals.

A way forward for competition policy

I propose a rechanneling of modern antitrust and regulatory policy in two directions. To start, concerns of accumulation of market power in one relevant market should be systematically filtered through a prior examination of several dimensions of competition, in order to establish whether the firm under scrutiny is a moligopolist. I call this the ‘moligopoly screen’.

If the firm under scrutiny is a moligopolist subject to fierce multi-dimensional rivalry, this should be the end of the antitrust or regulatory inquiry. For consumers, this will ensure that a steady flow of innovative products will continue reaching the market. If the multi-dimensional, moligopoly competition is insufficient, the antitrust inquiry should focus in priority on conduct that elevates barriers on entrepreneurial resources, which are the engine of competition in digital markets.

Moligopoly screen

A possible way to measure the multi-dimensional degree of moligopoly competition is by using firm-level variables. The firm’s degree of diversification suggests a commitment to compete against the non-consumption. And the firm’s direct and indirect R&D investments give indications of its commitment to compete for entrepreneurial assets.

Key data points are the absolute and relative size, the open-ended versus the purpose-driven nature and direction of R&D investments, the number and range of product segments, the profit allocation choices (retained earnings opposed to dividends and buybacks) and the transactional activity (M&A, VC, CVC). Those tools, in turn, could assist antitrust and regulatory agencies in discriminating between pro- and anticompetitive tech firms.

Barriers to entrepreneurial assets

Above this screen, competition and regulatory policy should focus on three categories of anticompetitive restraints that potentially harm the free exchange of entrepreneurial resources.

First, antitrust and regulatory policy must scrutinize restraints to capital. Entrepreneurs’ ability to raise capital equity may be limited by the existence of a moligopoly firm. Anecdotal evidence suggests that VC and CVC refuse to fund start-ups that operate in markets exposed to threats of moligopoly entry. Journalists refer to this as the ‘kill zone’ of FAANG firms.

This necessitates an extensive consideration of competitive pressures, well beyond the traditional assessment of actual and potential competition within existing relevant markets. Moreover, antitrust and regulatory analysis must balance this conjecture with the possibility that moligopoly positions act as ‘lighthouses’ for entrepreneurs. The kill zone may incentivize entrepreneurs to channel their efforts towards products or services that bypass, disintermediate, leapfrog or pre-empt moligopolies.

Second, antitrust and regulatory policy should focus on labor restraints. Non-compete clauses that ‘restrict an employee’s post-employment ability to work for a competitor or start a competing company’ hold the potential to harm innovation in digital markets. They limit the supply of skills in the labor market, raise the opportunity costs of entrepreneurship, discourage entry and reduce the spillovers of knowledge towards other firms. Even in countries where they are unlawful, ‘non-competes’ remain present in many employment contracts. In California, for example, non-compete clauses appear in 22 percent of employment contracts. Hiring firms know that regardless of the law, non-compete clauses dissuade worker mobility, because of information and litigation costs. The fact that non-compete clauses remain used, despite any statutory legislation that prescribes non-enforceability, justifies stronger remedies that deter, such as antitrust fines or regulation.

Third, antitrust and regulatory policy should focus on platform governance. Moligopolists are imposing commercial and technical obligations upon developers of complementary applications, content providers or merchants that use their platforms. So, vertical platform control is necessary, because upstream players do not internalize the harmful effects of their actions upon third-party users (upon safety, confidentiality, security and content moderation). At the same time, vertical platform control may disguise strategic anticompetitive conduct. In cases where platforms enjoy life-and-death power over supply-side users, antitrust and regulatory policy can be designed to ensure due process in platform access, removal or management decisions. On the other hand, antitrust and regulation should avoid policies that increase returns to vertically integrated business models with little openness and hardly any interoperability.

Conclusion

Moligopoly competition is like Game of Thrones. In the long term, it is more akin to a survivalist game than to a profit-maximizing one, as Nobel Prize economist Armen Alchian once observed.

Moreover, the metaphor is particularly apt in the short term, because moligopolies operate like HBO’s Game of Thrones families: they compete with highly distinct capabilities and resources across various territories. In digital Westeros, Apple is the Lannisters: it sits atop a mountain of cash, enjoys strong legacy products, and its internal processes are very secretive. Amazon is the Targaryen family. It is a big bazaar, host to many communities; it raises its army at a methodical pace; and it has a dragon’s ability to fly to any market: it scares every other tech player. Microsoft is the House of Stark of Winterfell: it’s become the good guy of big tech, to the point that it is out of the FAANG acronym. Like Ned and Rob Stark, Microsoft has paid a big price in the past: its monopoly was decapitated, leading to the departure of its two legendary CEOs Bill Gates and Steve Ballmer.

More seriously, the moligopoly theory can be used to cover other firms’ strategies than the FAANGs’, as long as they are competing four-dimensionally. In fact, statements by FAANGs regarding their possible competitors point to other possible moligopolists, like Cisco Systems, IBM, Intel, Qualcomm, Oracle, et cetera. At the same time, some FAANGs may not deserve to be called moligopolists if they essentially compete in substitute products and services, in which case established antitrust and regulatory policy can proceed at full speed.

References

Petit, N. (2016) Technology giants, the ‘moligopoly’ hypothesis and holistic competition: a primer. Working Paper, 22 October.

Petit, N. (2019) Tech giants, competition and innovation. Oxford University Press. Forthcoming.

Auteur

Categorieën